Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

Filed by a Party other than the Registrant ☐ |

Check the appropriate box: |

☐ Preliminary Proxy Statement |

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ Definitive Proxy Statement |

☐ Definitive Additional Materials |

☐ Soliciting Material Pursuant to §240.14a-12 |

Quaint Oak Bancorp, Inc. |

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than Registrant) |

Payment of Filing Fee (Check the appropriate box): | |

☒ No fee required. | |

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

(1) Title of each class of securities to which transaction applies: |

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

☐ Fee paid previously with preliminary materials. |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

(1) Amount previously paid: |

(2) Form, schedule or registration statement no.:

(3) Filing party: |

(4) Date filed: |

(3) Filing party:

(4) Date filed:

April 6, 20223, 2024

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders of Quaint Oak Bancorp, Inc. The meeting will be held at our headquarters, located at 501 Knowles Avenue, Southampton, Pennsylvania, 18966 on Wednesday, May 11, 20228, 2024 at 2:00 p.m., Eastern time. The matters to be considered by shareholders at the annual meeting are described in the accompanying materials.

It is very important that your shares be voted at the annual meeting regardless of the number you own or whether you are able to attend the meeting in person. We urge you to mark, sign, and date your proxy card today and return it in the envelope provided, even if you plan to attend the annual meeting. This will not prevent you from voting in person, but will ensure that your vote is counted if you are unable to attend.

On behalf of the Board of Directors and all of the employees of Quaint Oak Bancorp, I thank you for your continued interest and support.

Sincerely,

| |

| |

Robert T. Strong | |

President and Chief Executive Officer |

QUAINT OAK BANCORP, INC. 501 Knowles Avenue Southampton, Pennsylvania 18966 (866) 795-4499

| |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS | |

TIME | 2:00 p.m., Eastern time, Wednesday, May |

PLACE | Quaint Oak Bank 501 Knowles Avenue Southampton, Pennsylvania 18966 |

ITEMS OF BUSINESS |

|

| To transact such other business, as may properly come before the meeting or at any adjournment thereof. We are not aware of any other such business. | |

RECORD DATE | Holders of Quaint Oak Bancorp common stock of record at the close of business on March |

ANNUAL REPORT | Our |

PROXY VOTING | It is important that your shares be represented and voted at the meeting. You can vote your shares by completing and returning the proxy card sent to you. Most shareholders whose shares are held in “street” name with a broker or other nominee can also vote their shares over the Internet or by telephone. If Internet or telephone voting is available to you, voting instructions are printed on the voting instruction form you received. You can revoke a proxy at any time prior to its exercise at the meeting by following the instructions in the accompanying proxy statement. |

BY ORDER OF THE BOARD OF DIRECTORS

Diane J. Colyer Corporate Secretary | |

Southampton, Pennsylvania April | |

TABLE OF CONTENTS | |

Page | |

About the Annual Meeting of Shareholders | 1 |

Information with Respect to Nominees for Director, Continuing Directors and Executive Officers | 3 |

Election of Directors (Proposal One) | 3 |

Directors Whose Terms Are Continuing | 4 |

Executive Officers Who Are Not Also Directors | 6 |

Committees and Meetings of the Board of Directors | 6 |

Board Leadership Structure | 7 |

Directors’ Attendance at Annual Meetings | 8 |

Director Nominations | 8 |

Director Compensation | 8 |

Executive Compensation | 9 |

|

|

|

|

| 10 |

Outstanding Equity Awards at Fiscal Year-End | 11 |

Employment Agreements | 11 |

Retirement Benefits | 12 |

Related Party Transactions | 13 |

Ratification of Appointment of Independent Registered Public Accounting Firm (Proposal Two) | 13 |

Audit Fees | 13 |

Report of the Audit Committee | 14 |

| |

Beneficial Ownership of Common Stock by Certain Beneficial Owners and Management | 15 |

Delinquent Section 16(a) Reports | 16 |

Shareholder Proposals, Nominations and Communications with the Board of Directors | 17 |

Annual Reports | 18 |

Other Matters | 18 |

PROXY STATEMENT

OF

QUAINT OAK BANCORP, INC.

ABOUT THE ANNUAL MEETING OF SHAREHOLDERS |

We are furnishing this proxy statement to holders of common stock of Quaint Oak Bancorp, Inc., the parent holding company of Quaint Oak Bank. Proxies are being solicited on behalf of our Board of Directors for use at the Annual Meeting of Shareholders to be held at our corporate headquarters located at 501 Knowles Avenue, Southampton, Pennsylvania, 18966 on Wednesday, May 11, 20228, 2024 at 2:00 p.m., Eastern time, and at any adjournment thereof for the purposes set forth in the attached Notice of Annual Meeting of Shareholders. This proxy statement is first being mailed to shareholders on or about April 6, 2022.3, 2024.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on May 11, 2022.8, 2024. This proxy statement and our 20212023 Annual Report are available on our website at www.quaintoak.com/investors/annual-meeting.

What is the purpose of the annual meeting?

At our annual meeting, shareholders will act upon the matters outlined in the attached Notice of Annual Meeting of Shareholders, including the election of directors and the ratification of our independent registered public accounting firm and the adoption of a non-binding resolution to approve the compensation of our named executive officers.firm. In addition, management may report on the performance of Quaint Oak Bancorp and respond to questions from shareholders.

Who is entitled to vote?

Only our shareholders of record as of the close of business on the voting record date for the annual meeting, March 22, 2022,19, 2024, are entitled to vote at the meeting. On the record date, we had 2,012,642 2,493,154shares of common stock issued and outstanding and no other class of equity securities outstanding. For each issued and outstanding share of common stock you own on the record date, you will be entitled to one vote on each matter to be voted on at the meeting, in person or by proxy.

How do I submit my proxy?

After you have carefully read this proxy statement, indicate on your proxy card how you want your shares to be voted. Then sign, date and mail your proxy card in the enclosed prepaid return envelope as soon as possible. This will enable your shares to be represented and voted at the annual meeting.

If my shares are held in “street name” by my broker, could my broker automatically vote my shares?

Your broker may not vote on the election of directors or the proposal to adopt a non-binding resolution to approve the compensation of our named executive officers if you do not furnish instructions for such proposal to your broker. You should use the voting instruction form or broker card provided by the institution that holds your shares to instruct your broker to vote your shares or else your shares may not be voted or may be considered “broker non-votes.”

Your broker may vote in his or her discretion on the ratification of the appointment of our independent registered public accounting firm if you do not furnish instructions. If your broker votes in his or her discretion on proposal two and you did not provide instructions for proposalsproposal one, or three, then your shares will be considered “broker non-votes” on proposals one or three.proposal one.

Can I attend the meeting and vote my shares in person?

All shareholders are invited to attend the annual meeting. Shareholders of record can vote in person at the annual meeting. If your shares are held in “street name,” then you are not the shareholder of record and you must ask your broker or other nominee about how you can vote at the annual meeting.

Can I change my vote after I return my proxy card?

Yes. If you are a shareholder of record, there are three ways you can change your vote or revoke your proxy after you have sent in your proxy card.

● | First, you may complete and submit a new proxy card. Any earlier proxies will be revoked automatically. |

● | Second, you may send a written notice to the Secretary of Quaint Oak Bancorp, Inc., Ms. Diane J. Colyer, Corporate Secretary, Quaint Oak Bancorp, Inc., 501 Knowles Avenue, Southampton, Pennsylvania 18966, in advance of the meeting stating that you would like to revoke your proxy. |

● | Third, you may attend the annual meeting and vote in person. Any earlier proxy will be revoked. However, attending the annual meeting without voting in person will not revoke your proxy. |

If your shares are held in street name and you have instructed a broker or other nominee to vote your shares, you must follow directions you receive from your broker or other nominee to change your vote.

What constitutes a quorum?

The presence at the annual meeting, in person or by proxy, of the holders of a majority of the votes that all shareholders are entitled to cast on a particular matter to be acted upon at the annual meeting will constitute a quorum. Proxies received but marked as abstentions will be included in the calculation of the number of votes considered to be present at the meeting.

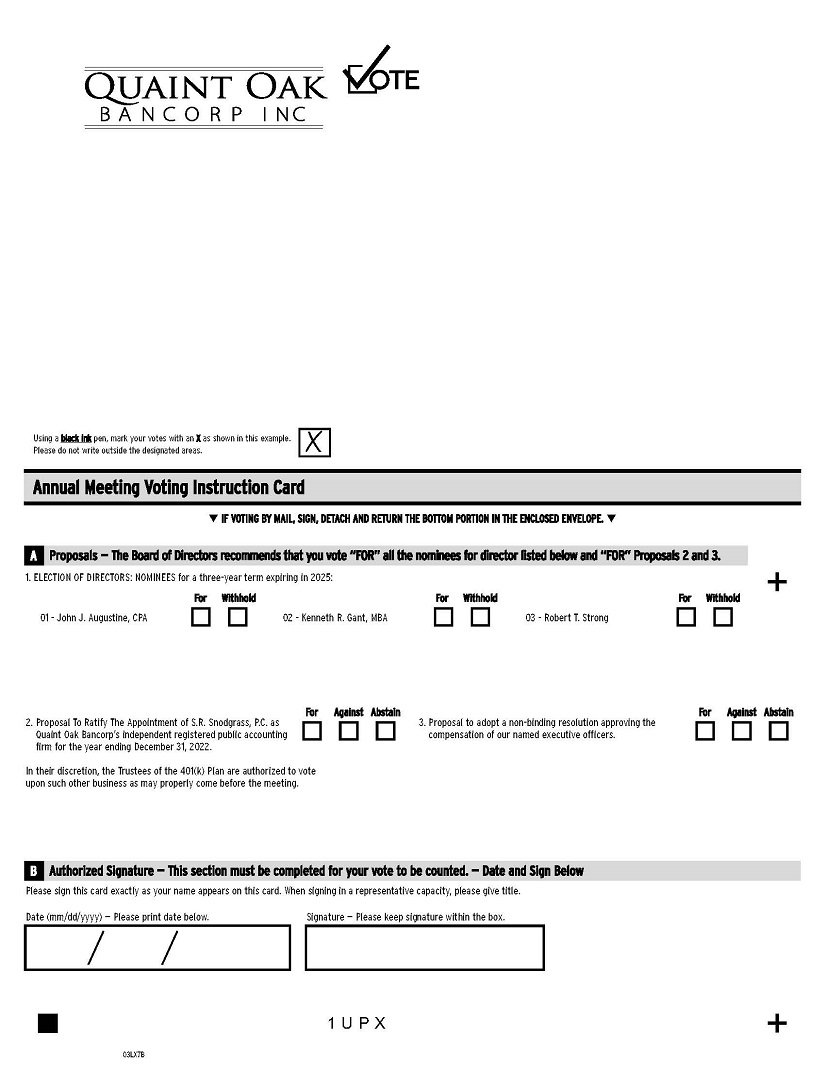

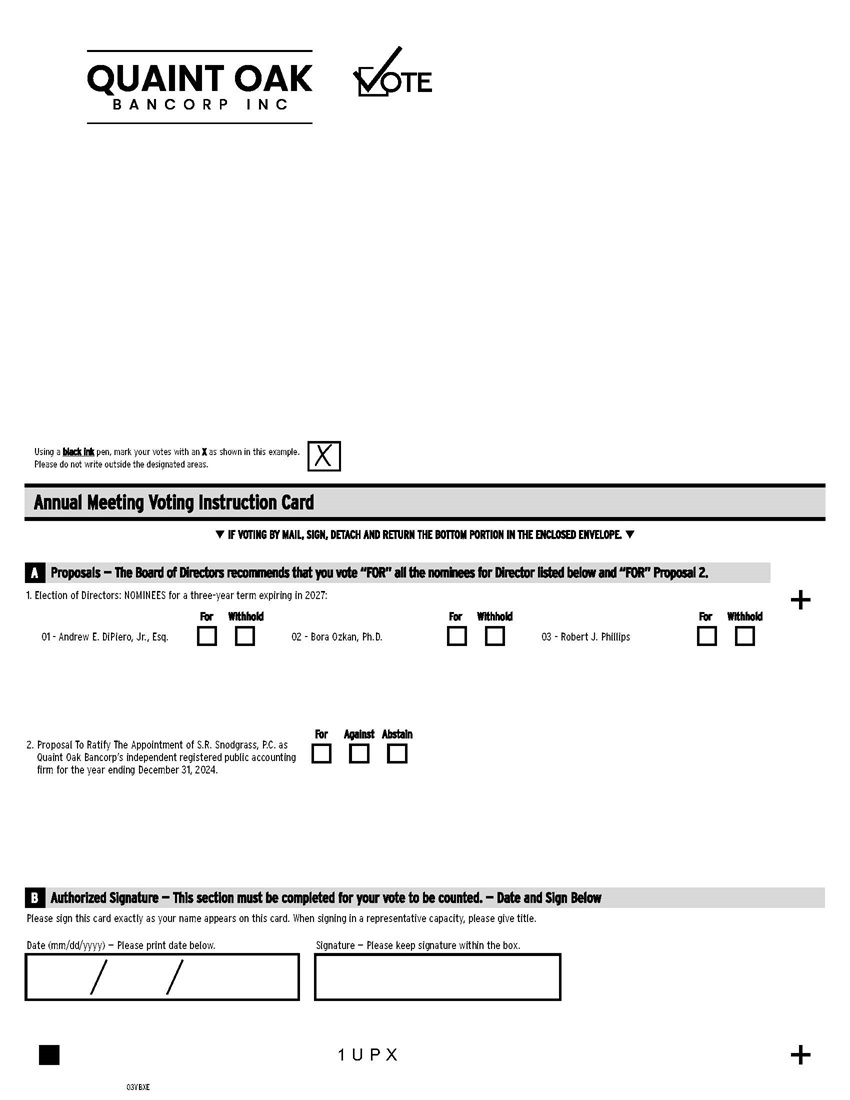

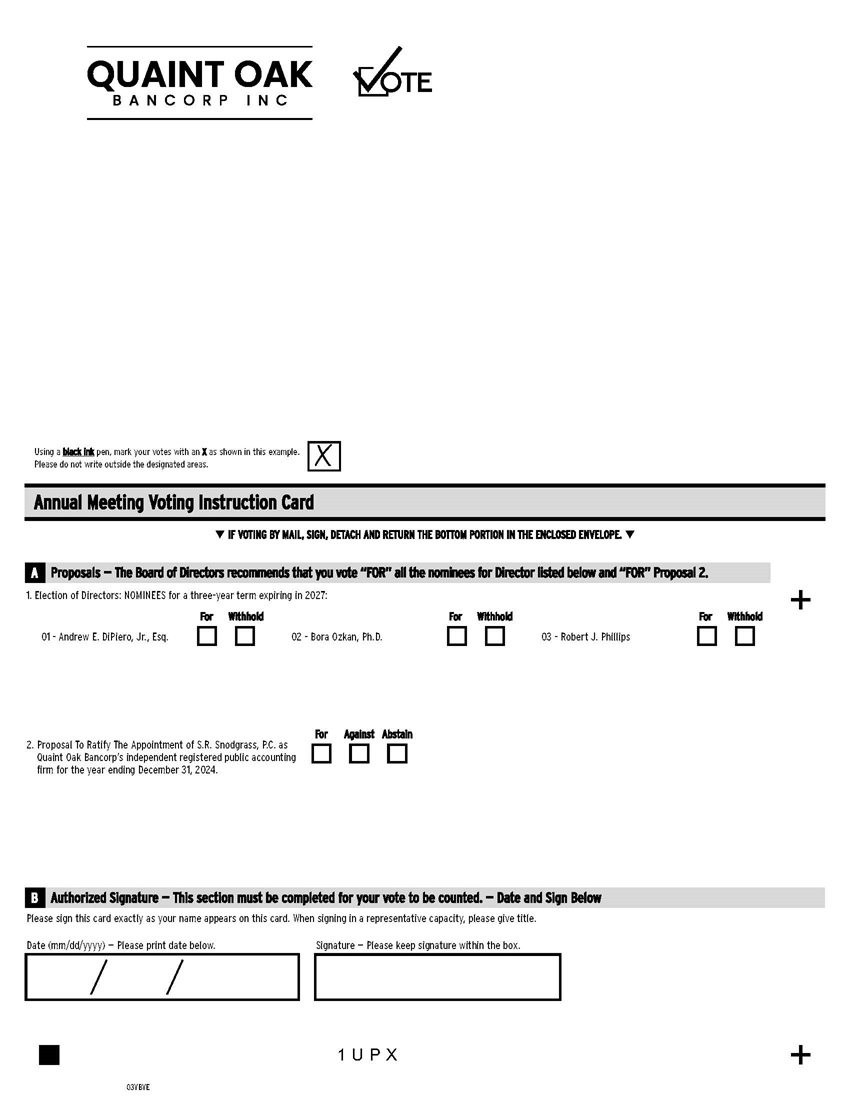

What are the Board of Directors’ recommendations?

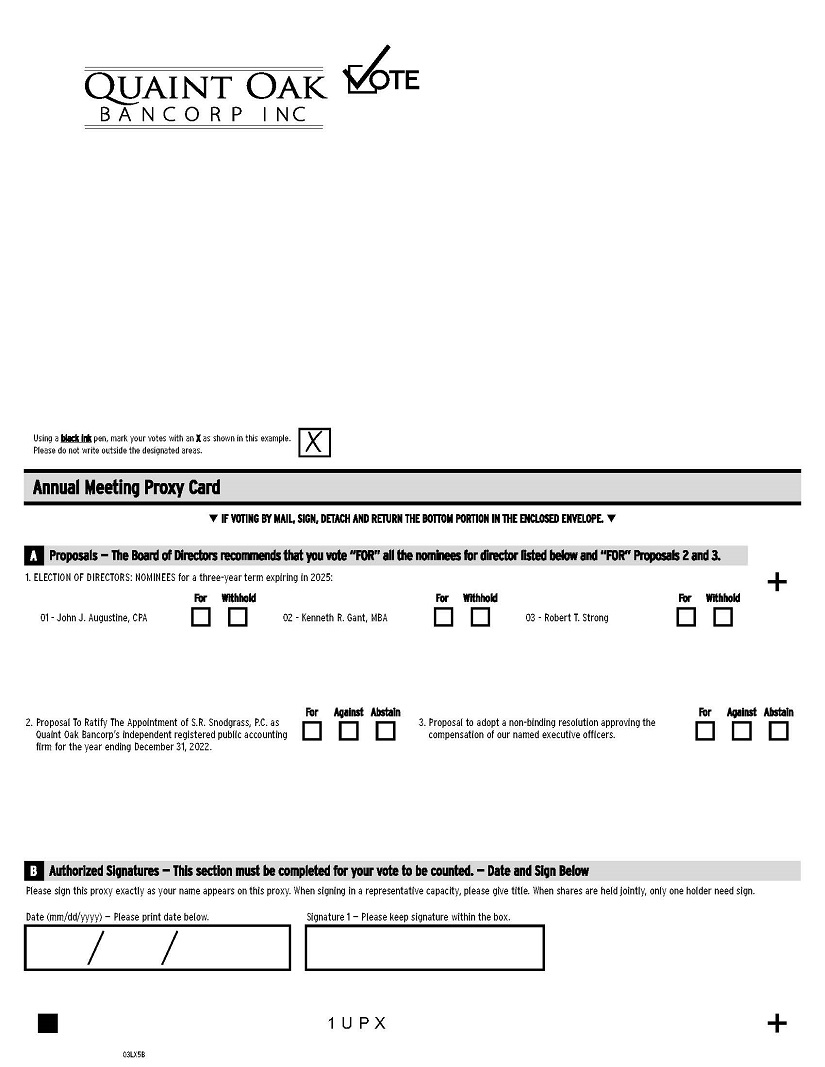

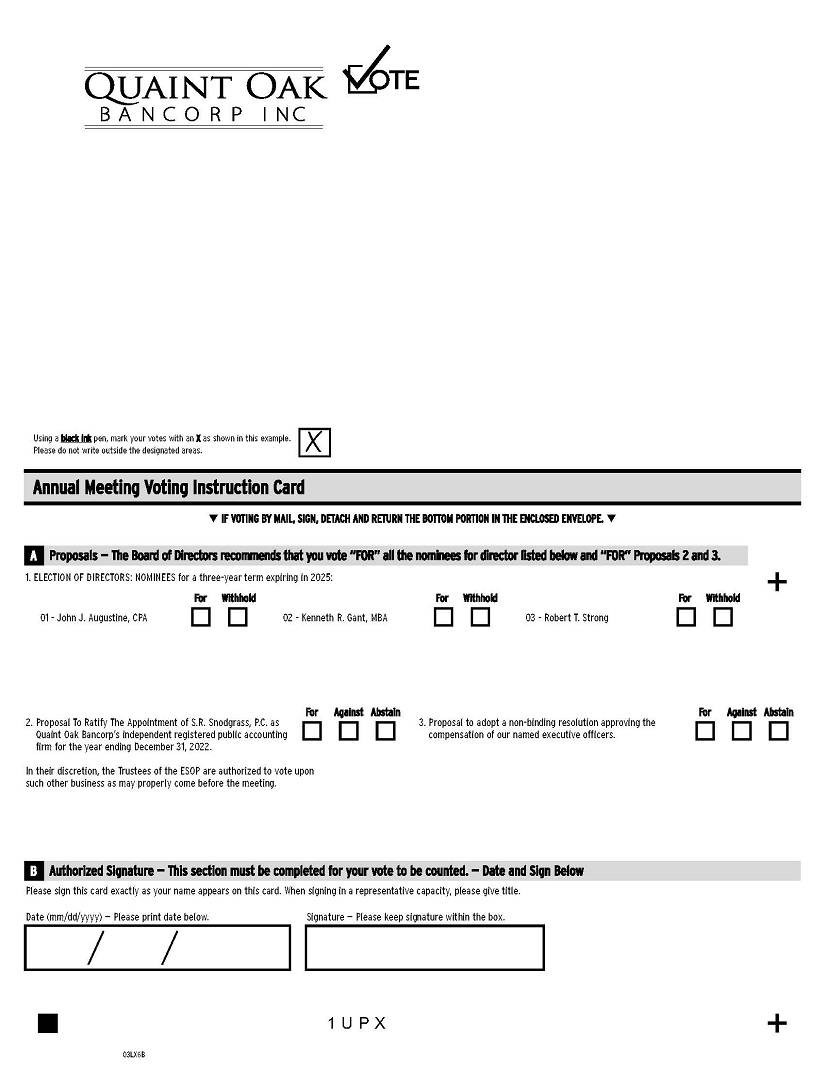

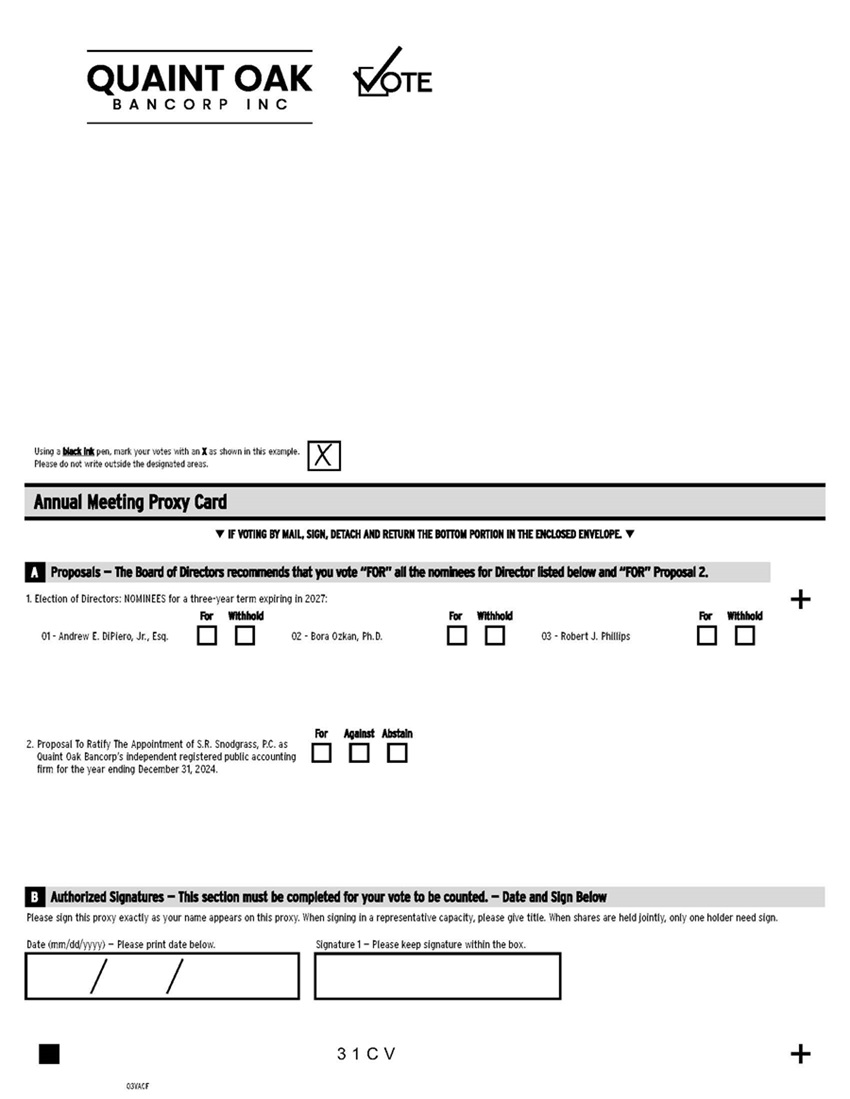

The recommendations of the Board of Directors are set forth under the description of each proposal in this proxy statement. In summary, the Board of Directors recommends that you vote (i) FOR the nominees for director described herein and (ii) FOR ratification of the appointment of S.R. Snodgrass, P.C. as our independent registered public accounting firm for the year ending December 31, 2022 and (iii) FOR approval of the non-binding resolutions to approve the compensation of our named executive officers.2024.

The proxy solicited hereby, if properly signed and returned to us and not revoked prior to its use, will be voted in accordance with your instructions contained in the proxy. If no contrary instructions are given, each proxy signed and received will be voted in the manner recommended by the Board of Directors and, upon the transaction of such other business as may properly come before the meeting, in accordance with the best judgment of the persons appointed as proxies. Proxies solicited hereby may be exercised only at the annual meeting and any adjournment of the annual meeting and will not be used for any other meeting.

What vote is required to approve each item?

Directors are elected by a plurality of the votes cast with a quorum, a majority of the outstanding shares entitled to vote represented in person or by proxy, present. The three persons who receive the greatest number of votes of the holders of common stock represented in person or by proxy at the annual meeting will be elected directors. The affirmative vote of a majority of the votes cast by shareholders entitled to vote at the annual meeting is required for the approval of the proposal to ratify the appointment of our independent registered public accounting firm for the year ending December 31, 2022 and for approval of the proposal to adopt the non-binding resolution to approve the compensation of our named executive officers.2024. Under the Pennsylvania Business Corporation Law, abstentions and broker non-votes do not constitute votes cast and will not affect the vote required for the proposal to ratify the appointment of the independent registered public accounting firm.

INFORMATION WITH RESPECT TO NOMINEES FOR DIRECTOR, CONTINUING DIRECTORS AND EXECUTIVE OFFICERS |

Election of Directors (Proposal One)

Our Articles of Incorporation provide that the Board of Directors will be divided into three classes as nearly equal in number as the then total number of directors constituting the Board of Directors permits. The directors are elected by our shareholders for staggered terms, and until their successors are elected and qualified. At the annual meeting, shareholders of Quaint Oak Bancorp will be asked to elect one class of directors, consisting of three directors, for a three-year term expiring in 2025,2027, and until their successors are elected and qualified.

Our Nominating and Corporate Governance Committee has recommended the re-election of Messrs. Augustine, GantDiPiero, Phillips and Strong.Ozkan. No director is related to any other director or executive officer by first cousin or closer, except Messrs. Ager and DiPiero who are brothers-in-law and Mr. Strong who is the father of Ms. Ott. Each nominee and each director whose term continues currently serves as a director of Quaint Oak Bancorp and its subsidiary, Quaint Oak Bank.

Unless otherwise directed, each proxy card signed and returned by a shareholder will be voted for the election of the nominees for director listed below and on the following page. If any person named as a nominee should be unable or unwilling to stand for election at the time of the annual meeting, the proxies will nominate and vote for any replacement nominee or nominees recommended by our Board of Directors. At this time, the Board of Directors knows of no reason why any of the nominees listed below and on the following page may not be able to serve as a director if elected.

The tables below and on the following pages present information concerning the nominees for director and each director whose term continues, including tenure as a director. Terms as directors for all directors other than Mr.Messrs. Clarke and Ozkan and Ms. Vettori include service as a director of Quaint Oak Bank prior to the formation of Quaint Oak Bancorp in 2007. Ages are reflected as of March 22, 2022.19, 2024.

Nominees for Director for a Three-Year Term Expiring in 2027

Name | Age and Principal Occupation During the Past Five Years/ Public Directorships | |

Andrew E. DiPiero, Jr., Esq. | Director. Attorney with Baratta Law LLC, Huntingdon Valley, Pennsylvania, since November 2011. Prior thereto, Partner with Stampone, D’Angelo, Renzi, DiPiero, Attorneys at Law, P.C., Cheltenham, Pennsylvania, since June 2004. Age 71. Mr. DiPiero has served as a Director since 1984 and holds the position of Chairman of the Audit Committee. He brings the expertise of a practicing attorney to the Board of Directors and has an insight into both the Delaware and the Lehigh Valley market areas, having represented numerous clients in these areas. Additionally, he is Board Certified as a Civil Trial Advocate by the National Board of Trial Advocacy. Mr. DiPiero is AV rated by Martindale Hubbell and has been awarded the designation of Super Lawyer by Philadelphia Magazine for every year since 2006. |

Nominees for Director for a Three-Year Term Expiring in 2027 (Continued)

Name | Age and Principal Occupation During the Past Five Years/ Public Directorships | |

Robert J. Phillips | Chairman of the Board of Quaint Oak Bancorp and Quaint Oak Bank since 2007 and 1984, respectively. Currently retired. Previously, President, Shipping Connections, Inc., Bristol, Pennsylvania from October 1996 to October 2003. Age 77. Mr. Phillips has served as a director since 1968 and Chairman since 1984. Mr. Phillips also acts as a liaison to the Bank’s community serving in the position of Director and past President of the Centennial Education Foundation along with being a Director and past President of the Southampton Business and Professional Association. | |

Bora Ozkan, Ph.D. | Director. Associate Professor of Finance of Temple University, Philadelphia, PA since 2020 and prior thereto, Assistant Professor of Finance from 2014 to 2020. Mr. Ozkan also serves as Academic Director of Online MBA and Online BBA, Temple University, since 2018. Previously, Mr. Ozkan served as Managing Director of Capital Markets Room, Temple University, from 2014 to 2020. Age 46. Dr. Ozkan brings expertise in fintech, ESG, corporate finance, emerging markets real estate, and business education to the Board. Dr. Ozkan has significant professional experience in international marketing and strategy, with a robust understanding of global financial markets. Dr. Ozkan holds advanced degrees in financial economics and business administration from the University of New Orleans, where he was recognized with a Dean’s Scholarship for his doctoral studies. |

The Board of Directors recommends that you vote FOR election

of the nominees for Director.

Directors Whose Terms Are Continuing

Directors Whose Terms Expire in 2025

Name | Age and Principal Occupation During the Past Five Years/ Public Directorships | |

John J. Augustine, CPA | Director. Chief Financial Officer of Quaint Oak Bancorp and Chief Financial Officer and Treasurer of Quaint Oak Bank since October 5, 2009 and Executive Vice President of Quaint Oak Bancorp and Quaint Oak Bank since May 2016 and May 2013, respectively. Previously, Senior Audit Manager of Teleflex, Inc., Limerick, Pennsylvania from February 2006 to September 2009. Prior thereto, Mr. Augustine was a self-employed consultant for JJA Consulting, Lansdale, Pennsylvania from January 2004 to February 2006; and Executive Vice President and Chief Financial Officer of Reda Sports, Inc., West Easton, Pennsylvania from March 1997 to January 2004. Age

| |

Mr. Augustine has served as a Director since 2000. As a certified public accountant, he brings extensive business and consulting experience to the Board. He has more than 25 years of service with financial institutions, including serving as Vice President and Controller for Vista Bancorp, Inc., and Assistant Controller of Germantown Savings Bank. | ||

Kenneth R. Gant, MBA | Director.

Mr. Gant has served as a Director since 1986, and brings the perspective of risk management to the Board from his business life involvement, at many levels, in the insurance business. Mr. Gant has also earned his MBA degree which brings a higher view of business activities to his position as Director. Mr. Gant also holds the CIC (Certified Insurance Counselor), CPCU (Chartered Property and Casualty Underwriter) and CRM (Certified Risk Manager) designations. |

Directors Whose Terms Expire in 2025 (Continued)

Name | Age and Principal Occupation During the Past Five Years/ Public Directorships | |

Robert T. Strong | Director. President and Chief Executive Officer of Quaint Oak Bancorp and Quaint Oak Bank since March 2007 and June 2001, respectively. Previously, Owner and President of Strong Financial Corporation, Southampton, Pennsylvania. Prior thereto, Mr. Strong was responsible for residential mortgage banking as Senior Vice President of Prime Bank, Fort Washington, Pennsylvania. Age

| |

Mr. Strong has served as a Director since 2000 and, having focused his professional career in banking brings an extensive background in financial institutions and leadership expertise to the Board. Mr. Strong also brings entrepreneurial business knowledge and experience to the Board through his prior ownership and operation of Strong Financial Corporation. |

The Board of Directors recommends that you vote FOR election

of the nominees for Director.

Directors Whose Terms are Continuing

Directors Whose Terms Expire in 20232026

Name | Age and Principal Occupation During the Past Five Years/ Public Directorships | |

George M. Ager | Director.

| |

Mr. Ager has served as a Director since 1968 and brings the perspective of intimate knowledge of the Philadelphia area to the Board. Philadelphia has been described as a City of neighborhoods and Mr. Ager has worked the majority of them through his prior employment with a major utility company. This geographic knowledge overlays the Bank’s major | ||

James J. Clarke, Ph.D. | Director. Principal of Clarke Consulting, Villanova, Pennsylvania, a financial institution consulting firm specializing in asset/liability management, strategic planning and board/management education, since 2002. Trustee of Reliance Bank, Altoona, Pennsylvania since August 1995. Trustee of Phoenixville Federal Bank and Trust, Phoenixville, Pennsylvania from January 2011 to 2015. Director and Chair of the Audit Committee of Wright Investors’ Service, a privately held company, Milford, Connecticut, from 2002 to 2018. Director of First Financial Bank, Downingtown, Pennsylvania and its public holding company, Chester Valley Bancorp, Inc., from 2004 to 2005. Prior thereto, Mr. Clarke served as Professor of Finance and Economics, Villanova University from 1972 to 2002. Age

| |

Mr. Clarke has served as a Director since 2007 and holds the position of Chairman of the Asset and Liability Committee. His background as a professor of finance and economics and currently as a consultant to the banking industry brings unusual depth and perspective as a |

Directors Whose Terms Expire in 2024Director.

|

| |

| Director.

| |

|

|

Executive Officers Who Are Not Also Directors

Set forth below is information with respect to the principal occupations during the last five years for the fourthree executive officers of Quaint Oak Bancorp and/or our subsidiary, Quaint Oak Bank, who do not also serve as directors of Quaint Oak Bancorp. Ages are reflected as of March 22, 2022.19, 2024.

Diane J. Colyer, age 6365 years, has served as Senior Vice President of Quaint Oak Bancorp since May 2016 and Corporate Secretary since April 2007. Previously, Ms. Colyer served as Chief Operating Officer of Quaint Oak Bancorp from October 2009 through May 2016 and Treasurer of Quaint Oak Bancorp from July 2008 through May 2010. Ms. Colyer also serves as Senior Vice President of Quaint Oak Bank since May 2016 and Corporate Secretary since April 2007. Previously, Ms. Colyer served as Chief Operating Officer of Quaint Oak Bank from October 2009 through May 2016, Treasurer of Quaint Oak Bank from May 2009 through May 2010, System Security Officer from July 2000 to May 2014, and Network Administrator from May 2001 to May 2014. Ms. Colyer has served as Corporate Secretary of Quaint Oak Mortgage, LLC since July 2009 and as Senior Vice President and Corporate Secretary of Quaint Oak Mortgage, LLC since May 2019.

William R. Gonzalez, age 3840 years, has served as Executive Vice President and Chief Operating Officer of Quaint Oak Bank since January 2023. Previously, Mr. Gonzalez served as Executive Vice President of Quaint Oak Bank since May 2020 through December 2022 and as Senior Vice President, Business Development from May 2013 through May 2020. Mr. Gonzalez has served as President and Chief Executive Officer of QOB Properties, LLC since May 2014. Mr. Gonzalez served as President and Chief Executive Officer of Quaint Oak Real Estate, LLC and Quaint Oak Abstract, LLC from July 2009 through May 2019. Mr. Gonzalez served as Executive Vice President and Chief Operating Officer of Quaint Oak Mortgage, LLC from July 2009 through April 2013 and as President and Chief Executive Officer from May 2013 through May 2019.

Aimee K. Ott, age 53 years, has served as Executive Vice President of Quaint Oak Bank since May 2020.2022. Previously, Mr. Gonzalez served as Senior Vice President, Business Development of Quaint Oak Bank from May 2013 through May 2020. Mr. Gonzalez has served as Executive Vice President of Quaint Oak Mortgage, LLC since May 2020 and previously served as President and Chief Executive Officer of Quaint Oak Mortgage, LLC from May 2013 through May 2019.

Robert Farrer, age 56 years, has served as Vice President Risk and Compliance since May 2016, Information Technology Security Officer since May 2014 and Community Reinvestment Act Officer since April 2006. Previously, Mr. Farrer served as Vice President Operations of Quaint Oak Bank from May 2015 through May 2016, Compliance Officer from April 2006 to May 2016 and Chief Risk Officer from May 2010 to May 2016. Mr. Farrer has served as Vice President Risk and Compliance of Quaint Oak Mortgage, LLC since May 2016.

Aimee K.Ms. Ott, age 51 years, has served as Senior Vice President of Quaint Oak Bank sincefrom May 2020. Previously,2020 to May 2022. Prior thereto, Ms. Ott served as Vice President Human Resources and Marketing of Quaint Oak Bank from May 2018 through May 2020, an Appointed Officer Vice President Human Resources and Marketing from May 2017 through May 2018, and an Appointed Officer Vice President Human Resources from May 2014 through May 2016. Ms. Ott has served as Senior Vice President, Human Resources and Marketing of Quaint Oak Mortgage, LLC since May 2020 and previously served as Vice President, Human Resources and Marketing of Quaint Oak Mortgage, LLC from May 2016 to May 2020.

Committees and Meetings of the Board of Directors

The Board of Directors of Quaint Oak Bancorp has established a Compensation Committee, Audit Committee and Nominating and Corporate Governance Committee. During the fiscal year ended December 31, 2021,2023, the Board of Directors of Quaint Oak Bancorp held twelvefourteen meetings. No director attended fewer than 75% of the total number of Board meetings and committee meetings on which he or she served that were held during this period. The Board of Directors has determined that a majority of its members are independent directors as “independent director” is defined in the Nasdaq listing standards. Our independent directors are Messrs. Ager, Clarke, DiPiero, Gant, Ozkan and Phillips.Phillips and Ms. Vettori.

Committee Membership. The following table sets forth the membership of the committees as of the date of this proxy statement.

Director | Audit | Compensation | Nominating and Corporate Governance | |||

James J. Clarke, Ph.D. | * | |||||

Andrew E. DiPiero, Jr., Esq. | ** | * | ||||

Kenneth R. Gant, MBA | * | * | ||||

Robert J. Phillips | * | ** | * | |||

Robert T. Strong | ** |

________________

* Member

** Chairman

Audit Committee. The primary purpose of the Audit Committee, as set forth in the committee’s charter, is to assist the Board of Directors in fulfilling its fiduciary responsibilities relating to corporate accounting and reporting practices. The Audit Committee reviews with management and the independent auditors the systems of internal control, reviews the annual financial statements, including the Annual Report on Form 10-K, and monitors our adherence in accounting and financial reporting to generally accepted accounting principles. The Board of Directors has not identified a member of the Audit Committee who meets the Securities and Exchange Commission’s definition of audit committee financial expert. The Board of Directors believes that the Audit Committee members have sufficient expertise to fulfill their fiduciary duties.

The Audit Committee meets on an as needed basis and met fourtwelve times in 2021.2023. The Board of Directors and the Audit Committee adopted an Audit Committee Charter which is available on our website at www.quaintoak.com under the “Investor Relations” heading.

Compensation Committee. The Compensation Committee reviews the compensation of our executive officers and met twicethree times in 2021.2023. No member of the Compensation Committee is a current or former officer or employee of Quaint Oak Bancorp or Quaint Oak Bank. The Compensation Committee has adopted a written charter which is available on our website at www.quaintoak.com under the “Investor Relations” heading.

Nominating and Corporate Governance Committee. Nominations for director of Quaint Oak Bancorp are reviewed by the Nominating and Corporate Governance Committee and submitted to the full Board of Directors for approval. The Nominating and Corporate Governance Committee met twiceonce during 2021.2023. Mr. Strong, who is our President and Chief Executive Officer, serves as a member of the Nominating and Corporate Governance Committee and its Chair. The Charter of the Nominating and Corporate Governance Committee is available on our website at www.quaintoak.com under the “Investor Relations” headingheading.

Board Leadership Structure

Mr. Robert T. Strong serves as our President and Chief Executive Officer and Mr. Robert J. Phillips serves as our Chairman of the Board. The Board of Directors has determined that the separation of the offices of Chairman of the Board and President enhances Board independence and oversight. Further, the separation of the Chairman of the Board permits the President and Chief Executive Officer to better focus on his responsibilities of managing the daily operations of Quaint Oak Bancorp and Quaint Oak Bank, enhancing shareholder value and expanding and strengthening our franchise while allowing the Chairman of the Board to lead the Board of Directors in its fundamental role of providing independent oversight and advice to management. Mr. Phillips is an independent director under the rules of the Nasdaq Stock Market.

Directors’Directors’ Attendance at Annual Meetings

Although we do not have a formal policy regarding attendance by members of the Board of Directors at annual meetings of shareholders, we expect that our directors will attend, absent a valid reason for not doing so. All of our directors attended our annual meeting of shareholders held in May 2021.2023.

Director Nominations

The Nominating and Corporate Governance Committee’s charter sets forth certain criteria the committee may consider when recommending individuals for nomination to the Board including:

● | ensuring that the Board of Directors, as a whole, is diverse by considering: |

o | individuals with various and relevant career experience; |

o | relevant technical skills; |

o | industry knowledge and experience; |

o | financial expertise (including expertise that could qualify a director as a “financial expert,” as that term is defined by the rules of the U.S. Securities and Exchange Commission); and |

o | local or community ties, and |

● | minimum individual qualifications, including: |

o | strength of character; |

o | mature judgment; |

o | familiarity with our business and industry; |

o | independence of thought; and |

| o an ability to work collegially. |

The committee also may consider the extent to which the candidate would fill a present need on the Board of Directors. The Nominating and Corporate Governance Committee will also consider candidates for director suggested by other directors, as well as our management and shareholders. A shareholder who desires to recommend a prospective nominee for the Board of Directors should notify our Corporate Secretary in writing providing whatever supporting material the shareholder considers appropriate. Any shareholder wishing to make a nomination must follow our procedures for shareholder nominations which are described under “Shareholder Proposals, Nominations and Communications with the Board of Directors.”

Director Compensation

Director Compensation Table.The following table sets forth total compensation paid to each director who served as a director of Quaint Oak Bank during 2021,2023, other than Messrs. Strong and Augustine whose compensation is set forth below under “Executive Compensation.” Quaint Oak Bank does not have a defined benefit pension plan or retirement plan for the benefit of directors.

Name | Fees Earned or Paid in Cash | Stock Awards(1) | Option Awards(1) | Total | Fees Earned or Paid in Cash | Stock Awards(1) | Option Awards(1) | Total | ||||||||||||||||||||||||

George M. Ager, Jr. | $ | 25,100 | $ | -- | $ | -- | $ | 25,100 | $ | 28,475 | $ | 18,000 | $ | 16,300 | $ | 62,775 | ||||||||||||||||

James J. Clarke, Ph.D. | 24,800 | -- | -- | 24,800 | 27,425 | 18,000 | 16,300 | 61,725 | ||||||||||||||||||||||||

Andrew E. DiPiero, Jr., Esq. | 24,800 | -- | -- | 24,800 | 35,075 | 18,000 | 16,300 | 69,375 | ||||||||||||||||||||||||

Kenneth R. Gant, MBA. | 27,950 | -- | -- | 27,950 | ||||||||||||||||||||||||||||

Kenneth R. Gant, MBA | 33,200 | 18,000 | 16,300 | 67,500 | ||||||||||||||||||||||||||||

Bora Ozkan, Ph.D.(2) | 15,575 | 18,000 | 16,300 | 49,875 | ||||||||||||||||||||||||||||

Robert J. Phillips | 66,700 | -- | -- | 66,700 | 73,325 | 18,000 | 16,300 | 107,625 | ||||||||||||||||||||||||

Susan M. Vettori | 25,175 | 18,000 | 16,300 | 59,475 | ||||||||||||||||||||||||||||

________________________

(1) These amounts represent the aggregate grant date fair value of stock awards and option grants during the year ended December 31, 2023, in accordance with FASB ASC Topic 718. The assumptions used for calculating the grant date fair value are set forth in Note 14 of our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2023 which was filed with the SEC on March 28, 2024. These amounts do not represent actual amounts paid to or realized by our directors for these awards during fiscal year 2023. As of December 31, 2021,2023, each of our non-employee directors held the following aggregate number of unvested stock awards and outstanding options:

Aggregate Number of Equity Awards Outstanding at Fiscal Year End | Aggregate Number of Equity Awards Outstanding at Fiscal Year End | |||||||||||||||

Name | Stock Awards | Option Awards | Stock Awards | Option Awards | ||||||||||||

George M. Ager, Jr. | 600 | 2,000 | 1,000 | 6,000 | ||||||||||||

James J. Clarke, Ph.D. | 600 | 2,000 | 1,000 | 5,100 | ||||||||||||

Andrew E. DiPiero, Jr., Esq. | 600 | 10,500 | 1,000 | 9,000 | ||||||||||||

Kenneth R. Gant, MBA | 600 | 5,000 | 1,000 | 8,000 | ||||||||||||

Bora Ozkan, Ph.D. | 1,000 | 5,000 | ||||||||||||||

Robert J. Phillips | 800 | 17,500 | 1,000 | 9,115 | ||||||||||||

Susan M. Vettori | 1,000 | 5,000 | ||||||||||||||

(2) Dr. Ozkan has served as a director of Quaint Oak Bank since November 2022 and received compensation reflected in the above table from Quaint Oak Bank during 2023 for such service.

Narrative to Director Compensation Table. Members of our Board of Directors receive no compensation for membership on the Board of Quaint Oak Bancorp. During 2021,2023, each director of Quaint Oak Bank, other than Messrs. Strong and Augustine, received an annual retainer of $8,000$9,000 and received $1,050$1,150 for each meeting of the Board of Directors, with one paid absence permitted per year.year, which was reduced to $575 per meeting in the fourth quarter of 2023. For meetings of the Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee, Loan Committee and ALCO Committee, members received $600 for each committee meeting, and Quaint Oak Bank’s Loan Committee members received $450 for each committee meeting.which was reduced to $300 per meeting in the fourth quarter of 2023. Mr. Phillips, as Chair of the Compensation and Loan Committees, received $750 and $500, respectively, per meeting as Chair. MembersChair, which for the Loan Committee, was reduced to $375 per meeting in the fourth quarter of 2023. Mr. DiPiero received $900 per meeting as Chair of the Audit Committee, received $600which was reduced to $450 per meeting attended in person and Mr. DiPiero received $750 per meeting as Chair.the fourth quarter of 2023. Messrs. Clarke and Gant, as Chairs of Quaint Oak Bank’s ALCO Committee and Risk Management Committee, respectively, received $750 per committee meeting.meeting, which for the Loan Committee, was reduced to $375 per meeting in the fourth quarter of 2023. The other ALCO and Risk Management Committee members are executive officers and did not receive committee meeting fees. Committee fees are paid only if the meeting is attended. In addition to the regular annual retainer and meeting fees, the Chairman of the Board received a fee of $3,000$3,250 per month during fiscal 2021.2023, which was reduced to $1,625 in the fourth quarter of 2023.

During the year ended December 31, 2018,2023, we made grants and awards of restricted stock and stock options to the members of our Board of Directors under our 20182023 Stock Incentive Plan. Each of our non-employee directors received a grant of 1,5001,000 shares of restricted stock and an award of 5,000 stock options, except for Mr. Phillips, our Chairman of the Board, who received a grant of 2,000 shares of restricted stock and an award of 7,500 stock options. The grants and awards of restricted stock and stock options are vesting at a rate of 20% per year commencing on May 9, 201910, 2024, and will be fully vested as of May 9, 2023.10, 2028. The stock options have an exercise price of $13.30$18.00 per share and must be exercised by, or will expire on, May 9, 2028.

Related Party Transactions

Certain of our directors and executive officers as well as members of their immediate families and others who are considered “related persons” under Item 404 of Regulation S-K of the SEC are also customers of Quaint Oak Bank. Any loans to related persons are made in the ordinary course of business on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with persons not related to Quaint Oak Bank. We had no loans outstanding to our directors, executive officers, any of their immediate family members or any related persons at December 31, 2021.10, 2033.

EXECUTIVE COMPENSATION |

Summary Compensation Table

The following table shows the compensation paid by Quaint Oak Bank to our President and Chief Executive Officer and the other two highest compensated executive officers of us or Quaint Oak Bank for the years ended December 31, 20212023 and 2020.2022.

Name and Principal Position | Year | Salary | Bonus(1) | Stock Awards | Option Awards | All Other Compensation(2) | Total | Year | Salary | Bonus(1) | Stock Awards(2) | Option Awards(2) | All Other Compensation(3) | Total | |||||||||||||||||||||||||||||||||||||

Robert T. Strong | 2021 | $ | 344,400 | $ | 250,032 | $ | -- | $ | -- | $ | 15,959 | $ | 610,391 | 2023 | $ | 369,724 | $ | -- | $ | 81,000 | $ | 48,900 | $ | 22,320 | $ | 521,944 | |||||||||||||||||||||||||

President and Chief Executive Officer | 2020 | 334,400 | 162,138 | -- | -- | 12,794 | 509,332 | 2022 | 361,700 | 237,147 | -- | -- | 28,600 | 627,447 | |||||||||||||||||||||||||||||||||||||

John J. Augustine | 2021 | 241,000 | 128,222 | -- | -- | 13,405 | 382,627 | 2023 | 265,000 | -- | 81,000 | 48,900 | 14,938 | 409,838 | |||||||||||||||||||||||||||||||||||||

Executive Vice President and Chief Financial Officer | 2020 | 234,000 | 72,962 | -- | -- | 12,826 | 319,788 | 2022 | 254,000 | 128,187 | -- | -- | 20,973 | 403,160 | |||||||||||||||||||||||||||||||||||||

William R. Gonzalez | 2021 | 195,000 | 96,166 | -- | -- | 11,005 | 302,171 | 2023 | 225,000 | -- | 81,000 | 48,900 | 10,508 | 365,408 | |||||||||||||||||||||||||||||||||||||

Senior Vice President, Business Development- Quaint Oak Bank | 2020 | 185,000 | 56,748 | -- | -- | 10,361 | 252,109 | ||||||||||||||||||||||||||||||||||||||||||||

Executive Vice President, and Chief Operating Officer Quaint Oak Bank | 2022 | 210,000 | 108,959 | -- | -- | 16,864 | 335,823 | ||||||||||||||||||||||||||||||||||||||||||||

__________________

(1) Reflects bonus for the year, paid in the following fiscal year.

(2) Reflects the grant date fair value in accordance with FASB ASC Topic 718 for stock awards and stock options that were granted during the fiscal year. The valuation of

the restricted stock awards is based on a grant date fair value of $18.00. The assumptions used in valuing the stock option awards are set forth in Note 14 to the

Consolidated Financial Statements included in the Annual Report on Form 10-K for the year ended December 31, 2023.

(3) Includes the fair market value, based on a closing price of $19.00$11.50 on December 31, 2021,2023, of the shares of Quaint Oak Bancorp common stock and cash dividends allocated

to the employee stock ownership plan accounts of Messrs. Strong, Augustine and Gonzalez and life insurance premiums. All other compensation does not include amounts

attributable to other miscellaneous benefits. The costs to Quaint Oak Bank of providing such benefits did not exceed $10,000.

Narrative to Summary Compensation Table. The Compensation Committee approved a base salary of $334,400$376,000 for Mr. Strong in 2021, the same amount as2023, an increase of 3.95% over his base salary for 2020.2022. During the fourth quarter of 2023, Mr. Strong’s base salary was reduced to $350,000. The dollar amount of his base salary was determined by the Compensation Committee’s review of the local market for chief executive officer compensation and was intended to ensure that Quaint Oak Bank remained competitive in attracting and retaining a qualified chief executive officer. The Compensation Committee approved a bonus pool for all executive officers for 2021 which was paid in 2022. The base amount of the bonus pool was 10% of the consolidated net income for the year ended December 31, 2021 of Quaint Oak Bank, excluding income of Quaint Oak Bancorp, with the total aggregate cash payout to executive officers not to exceed 120% of the bonus pool. Such aggregate payments totaled approximately 95% of the bonus pool for 2021. In determining the amount of the bonus pool allocated to Mr. Strong, the Compensation Committee utilized a performance matrix. The matrix consisted of the following six targets: loan growth; deposit growth; subsidiary production; efficiency ratio; Texas Ratio; and Camel rating, in addition to a limited discretionary amount. The Compensation Committee also considered the awards of restricted stock and grants of stock options to Mr. Strong during the year ended December 31, 2018. In addition, in 20212023 Mr. Strong received dues and membership fees for a local country club as a means of supporting business development. The Compensation Committee did not approve bonuses for executive officers for 2023.

At the annual meeting of shareholders of Quaint Oak Bancorp held on May 8, 2019, the shareholders recommended, on an advisory basis, that future advisory votes on executive compensation should be held every three years. Consistent with the shareholder recommendation, the Board of Directors of Quaint Oak Bancorp determined that it would hold an advisory vote on executive compensation every three years. The next advisory vote on the compensation of our named executive officers is beingwill be presented as proposal three at this 2022the 2025 annual meeting.

Pay versus Performance

The following table sets forth information concerning the compensation of our named executive officers for the fiscal years ended December 31, 2023 and 2022 and certain measures of our financial performance for those years.

Year | Summary Compensation Table Total for PEO (1) | Compensation Actually Paid to PEO (2) | Average Summary Compensation Table Total for Non-PEO Named Executive Officers (3) | Average Compensation Actually Paid to Non-PEO Named Executive Officers (2) | Value of Initial Fixed $100 Investment Based on: Total Shareholder Return (4) | Net Income (5) (in thousands) | ||||||||||||||||||

2023 | $ | 521,944 | $ | 198,139 | $ | 387,623 | $ | 78,556 | $ | 53.55 | $ | 2,020 | ||||||||||||

2022 | 627,447 | 693,587 | 369,492 | 408,744 | 119.15 | 7,863 | ||||||||||||||||||

__________________

(1) Represents the total compensation of our principal executive officer (“PEO”), Mr. Strong, as reported in the Summary Compensation Table for each year indicated. Mr. Strong

was the only person who served as our PEO during those years.

(2) Represents the “compensation actually paid” to Mr. Strong and to our non-PEO named executive officers, as calculated in accordance with Item 402(v) of Regulation S-K. The

following table presents the adjustments made to Mr. Strong’s and the non-PEO named executive officers’ Summary Compensation Table total for each year to determine their

average compensation actually paid.

Adjustments to Determine Compensation Actually Paid to | ||||||||

PEO | Non-PEO Named Executive Officers | |||||||

2023 | 2022 | 2023 | 2022 | |||||

Summary Compensation Table total | $ 521,944 | $ 627,447 | $ 387,623 | $ 369,492 | ||||

Increase for the change in fair value from the prior year-end to the end of the covered year of awards granted prior to the covered year that were outstanding and unvested as of the end of the covered year | (287,625) | 26,940 | (287,625) | 15,978 | ||||

Increase for the change in fair value from the prior year-end to the vesting date of awards granted prior to the covered year that vested during the covered year | (36,180) | 39,200 | (21,443) | 23,275 | ||||

Total Adjustments | $ 198,139 | $ 693,587 | $ 78,556 | $ 408,744 | ||||

(3) Represents the average of the total compensation of each of our non-PEO named executive officers (Messrs. Augustine and Gonzalez), as reported in the Summary Compensation Table

for each year indicated. Messrs. Augustine and Gonzalez were our only non-PEO named executive officers for those years.

(4) Represents the total return to shareholders of our common stock and assumes that the value of the investment was $100 on December 31, 2023 and December 31, 2022, respectively,

and that the subsequent dividends were reinvested. The stock price performance included in this column is not necessarily indicative of future stock price performance.

(5) Represents our reported net income for each year indicated.

Relationship Between Compensation Actually Paid to our PEO and the Average of the Compensation Actually Paid to the Other NEOs and the Company's Cumulative Total Shareholder Return (TSR) and the Company’s Net Income. From 2022 to 2023, the compensation actually paid to our PEO and the average of the compensation actually paid to the Other NEOs decreased by 71.4% and 80.8%, respectively, compared to a 55.1% decrease in our TSR over the same time period and 74.3% decrease in our Net Income over the same time period.

Outstanding Equity Awards at Fiscal Year-End

The table below sets forth outstanding equity awards at December 31, 20212023 to our named executive officers.

| Option Awards(1) | Stock Awards | Option Awards | Stock Awards | ||||||||||||||||||||||||||||||

Number of Securities Underlying Unexercised Options | Exercise Price | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested | Market Value of Shares or Units of Stock That Have Not Vested(4) | Number of Securities Underlying Unexercised Options |

|

| Number of Shares or Units of | Market Value of Shares or Units | |||||||||||||||||||||||||

| Name | Exercisable | Unexercisable | Exercisable | Unexercisable | Exercise Price | Option Expiration Date | Stock That Have Not Vested | of Stock That Have Not Vested(3) | ||||||||||||||||||||||||||

| Robert T. Strong | 30,000 | -- | $ | 8.10 | 5/8/2023(2) | 4,000 | (3) | $ | 76,000 | -- 14,962 | 15,000 -- | $ | 18.0013.30 | 5/10/2033(1) 5/9/2028(2) | 4,500(1) | $ | 51,750 | |||||||||||||||||

| 18,000 | 12,000 | 13.30 | 5/9/2028(3) | |||||||||||||||||||||||||||||||

| John J. Augustine | 20,000 | -- | 8.10 | 5/8/2023(2) | 3,000 | (3) | 57,000 | -- 17,000 | 15,000 -- | 18.0013.30 | 5/10/2033(1) 5/9/2028(2) | 4,500(1) | 51,750 | |||||||||||||||||||||

| 12,000 | 8,000 | 13.30 | 5/9/2028(3) | |||||||||||||||||||||||||||||||

William R. Gonzalez | 9,000 | 6,000 | 13.30 | 5/9/2028(3) | 2,000 | (3) | 38,000 | -- 11,220 | 15,000 -- | 18.0013.30 | 5/10/2033(1) 5/9/2028(2) | 4,500(1) | 51,750 | |||||||||||||||||||||

_____________________

(1) On September 8, 2015, Quaint Oak Bancorp effectedGranted pursuant to our 2023 Stock Incentive Plan and vesting at a two-for-one stock split. The numberrate of shares subject to each of the options expiring on20% per year commencing May 8, 2023 and exercise price of such options was adjusted to reflect the stock split.10, 2024.

(2) Granted pursuant to our 20132018 Stock Incentive Plan and vested at a rate of 20% per year commencing on May 8, 2014.9, 2019

(3) Granted pursuant to our 2018 Stock Incentive Plan and vesting at a rate of 20% per year commencing on May 9, 2019.

(4) Calculated by multiplying the closing market price of our common stock on December 31, 2021,2023, which was $19.00,$11.50, by the applicable number of shares of common stock

underlying the executive officer’s stock awards.

Employment Agreements

Quaint Oak Bank entered into an amended and restated employment agreement with Mr. Strong dated as of December 10, 2008, an employment agreement with Mr. Augustine dated as of September 14, 2012 and an employment agreement with Mr. Gonzalez dated as of March 30, 2018. The employment agreements have a three-year term which is automatically extended each year for a successive additional one-year period, unless a party to the agreement gives written notice not less than thirty (30) days nor more than ninety (90) days prior to the annual anniversary date, not to extend the employment term.

The employment agreements provide for minimum base salaries of $220,000, $154,500 and $155,000 to be paid to Messrs. Strong, Augustine and Gonzalez, respectively, which may be increased from time to time by the Board of Directors. The executives are also eligible for a bonus in such amount as determined by the Board of Directors at their discretion. The agreements provide for participation in employee benefit plans, currently consisting of life insurance, medical and dental, reimbursement for expenses incurred in performing their duties as officers of Quaint Oak Bank and paid vacation as approved by the Board of Directors.

The employment agreements are terminable with or without cause by Quaint Oak Bank. The executive has no right to compensation or other benefits pursuant to the employment agreement for any period after termination by Quaint Oak Bank for cause, as defined in the agreements. In the event that the employment agreements are terminated by Quaint Oak Bank other than for cause or by the executives as a result of certain adverse actions which are taken with respect to their employment following a change in control, as defined, of Quaint Oak Bank, then the executives will be entitled to a lump sum cash severance amount equal to 2.99 times their average annual compensation for the last three calendar years, subject to reduction pursuant to Section 280G of the Code, as set forth below.

A change in control is generally defined in the employment agreement to mean a change in the ownership or effective control of Quaint Oak Bancorp or Quaint Oak Bank or a change in the ownership of a substantial portion of the assets of Quaint Oak Bancorp or Quaint Oak Bank, in each case as provided under Section 409A of the Code and the regulations thereunder.

The employment agreements provide that, in the event any of the payments to be made thereunder are deemed to constitute “parachute payments” within the meaning of Section 280G of the Code, then such payments and benefits shall be reduced by the minimum necessary to result in the payments not exceeding three times the executive’s average annual compensation from Quaint Oak Bank that was includable in his gross income during the most recent five taxable years ending prior to the year in which the change in control occurs. As a result, the severance payment in the event of a change in control will not be subject to a 20% excise tax, and Quaint Oak Bank will be able to deduct such payment as compensation expense for federal income tax purposes.

In the event that prior to a change in control the employment agreement is terminated by Quaint Oak Bank other than for cause or the executive’s death or disability, or by the executive for “good reason,” as defined, then Quaint Oak Bank will pay the executive a lump sum cash severance payment equal to three times his current base salary within 30 days following his termination. Upon his death or disability, Quaint Oak Bank shall pay the executive or his estate or legal representative, a lump sum cash severance payment equal to one times his current base salary within 30 days following the date of termination of employment, plus a lump sum equal to the prorated portion of the bonus that would have been paid if he had remained employed for the full calendar year, based upon the portion of the year that he was able to perform his duties prior to his death or disability.

Retirement Benefits

Retirement benefits are an important element of a competitive compensation program for attracting senior executives, especially in the financial services industry. Our executive compensation program currently includes (i) a 401(k) profit sharing plan which enables our employees to supplement their retirement savings with elective deferral contributions and permits matching and discretionary contributions by us, and (ii) an employee stock ownership plan that allows participants to accumulate retirement benefits in the form of employer stock at no current cost to the participant.

401(k) and Profit Sharing Plan. We adopted the Quaint Oak Bank 401(k) Plan effective May 1, 2012. To participate in the 401(k) Plan, eligible employees must have completed two months of full time service and attained age 21. Participating employees may make elective salary reduction contributions of up to $19,500,$22,500 of their eligible compensation for 2021.2023. Quaint Oak Bank may contribute a matching contribution to the plan in an amount it determines each year. We are also permitted to make discretionary profit sharing contributions to be allocated to participant accounts.

Employee Stock Ownership Plan. In connection with the initial public offering of Quaint Oak Bancorp in July 2007, we establishedmaintains an employee stock ownership plan for the benefit of our eligible employees. The employee stock ownership plan acquired 222,180 shares of Quaint Oak Bancorp’s common stock (as adjusted for the two-for-one stock split) utilizing a $1.0 million loan from Quaint Oak Bancorp. The original loan to the employee stock ownership plan had a term of 15 years and was fully repaid as of September 30, 2021. Shares were released for allocation to employees’ accounts as the debt service payments were made. We may, at our discretion, make additional contributions of shares to the employee stock ownership plan and contributed 4,00011,320 shares for the quarteryear ended December 31, 2021.2023. Shares released from the suspense account or contributed to the employee stock ownership plan are allocated to each eligible participant's plan account pro rata based on compensation. Forfeitures may be used for the payment of expenses or be reallocated among the remaining participants. Participants become 100% vested after six years of service or normal retirement age. Participants also become fully vested in their account balances upon a change in control (as defined), death or disability. Benefits may be payable upon retirement or separation from service.

Related Party Transactions

Certain of our directors and executive officers as well as members of their immediate families and others who are considered “related persons” under Item 404 of Regulation S-K of the SEC are also customers of Quaint Oak Bank. Any loans to related persons are made in the ordinary course of business on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with persons not related to Quaint Oak Bank. We had no loans outstanding to our directors, executive officers, any of their immediate family members or any related persons at December 31, 2023.

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (Proposal Two) |

Our Audit Committee has appointed S.R. Snodgrass, P.C., independent registered public accounting firm, to perform the audit of Quaint Oak Bancorp’s financial statements for the year ending December 31, 2022,2024, and further directed that their selection be submitted for ratification by the shareholders at the annual meeting.

We have been advised by S.R. Snodgrass, P.C. that neither that firm nor any of its associates has any relationship with Quaint Oak Bancorp or Quaint Oak Bank other than the usual relationship that exists between independent registered public accounting firms and their clients. S.R. Snodgrass, P.C. will have one or more representatives at the annual meeting who will have an opportunity to make a statement, if they so desire, and will be available to respond to appropriate questions.

Audit Fees

The following table sets forth the aggregate fees paid by us to S.R. Snodgrass, P.C. for professional services in connection with the audit of Quaint Oak Bancorp’s consolidated financial statements for the years ended December 31, 2023 and 2022 and the fees paid by us to S.R. Snodgrass, P.C. for tax services during the years ended December 31, 2023 and 2022. No fees were paid by us to S.R. Snodgrass, P.C. for audited-related services or any other services rendered by S.R. Snodgrass, P.C. during fiscal 2023 or 2022.

Year Ended December 31, | ||||||||

2023 | 2022 | |||||||

Audit Fees(1) | $ | 117,686 | $ | 101,581 | ||||

Audit-related fees(2) | 28,624 | 43,645 | ||||||

Tax fees(3) | 29,698 | 20,550 | ||||||

All other fees | -- | -- | ||||||

Total | $ | 176,008 | $ | 165,776 | ||||

________________

(1) Audit fees consist of fees for professional services rendered for the audit of Quaint Oak Bancorp’s financial statements, review of financial statements included in

Quaint Oak Bancorp’s quarterly reports, financial and compliance audits required by HUD, and for services normally provided by the independent auditor in

connection with statutory and regulatory filings or engagements.

(2) Audit-related fees consist of fees related to the audit of Oakmont Capital Holdings, LLC for the years ended December 31, 2023 and 2022.

(3) Tax fees consist primarily of fees paid in connection with preparing federal and state income tax returns and other tax, audit and related services.

In determining whether to appoint S.R. Snodgrass, P.C. as our independent registered public accounting firm, the Audit Committee considered whether the provision of services, other than auditing services, by S.R. Snodgrass, P.C. is compatible with maintaining their independence. Each new engagement of S.R. Snodgrass, P.C. was approved in advance by the Audit Committee, and none of those engagements made use of the de minimis exception to pre-approval contained in the SEC’s rules.

The Audit Committee selects our independent registered public accounting firm and pre-approves all audit services to be provided by it to Quaint Oak Bancorp. The Audit Committee also reviews and pre-approves all audit-related and non-audit related services rendered by our independent registered public accounting firm in accordance with the Audit Committee’s charter. In its review of these services and related fees and terms, the Audit Committee considers, among other things, the possible effect of the performance of such services on the independence of our independent registered public accounting firm. The Audit Committee separately approves other individual engagements as necessary. The chair of the Audit Committee has been delegated the authority to approve audit-related and non-audit related services in lieu of the full Audit Committee and presents all such previously-approved engagements to the full Audit Committee.

Audit Fees

The following table sets forth the aggregate fees paid by us to S.R. Snodgrass, P.C. for professional services in connection with the audit of Quaint Oak Bancorp’s consolidated financial statements for the years ended December 31, 2021 and 2020 and the fees paid by us to S.R. Snodgrass, P.C. for tax services during the years ended December 31, 2021 and 2020. No fees were paid by us to S.R. Snodgrass, P.C. for audited-related services or any other services rendered by S.R. Snodgrass, P.C. during fiscal 2021 or 2020.

Year Ended December 31, | ||||||||

2021 | 2020 | |||||||

Audit Fees(1) | $ | 100,899 | $ | 94,772 | ||||

Audit-related fees | -- | -- | ||||||

Tax fees (2) | 13,700 | 13,600 | ||||||

All other fees | -- | -- | ||||||

Total. | $ | 114,599 | $ | 108,372 | ||||

____________________

(1) Audit fees consist of fees for professional services rendered for the audit of Quaint Oak Bancorp’s financial statements, review of financial statements included in Quaint Oak Bancorp’s quarterly reports, financial and compliance audits required by HUD, and for services normally provided by the independent auditor in connection with statutory and regulatory filings or engagements.

(2) Tax fees consist primarily of fees paid in connection with preparing federal and state income tax returns and other tax, audit and related services.

The Board of Directors recommends that you vote FOR the ratification of the appointment

of S.R. Snodgrass, P.C. as our independent registered public accounting firm

for the fiscal year ending December 31, 2022.2024.

REPORT OF THE AUDIT COMMITTEE |

The Audit Committee has reviewed and discussed Quaint Oak Bancorp’s audited consolidated financial statements with management. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed in PCAOB Auditing Standard No. 16, (Communications with Audit Committees). The Audit Committee has received the written disclosures and the letter from the independent accountant required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence and has discussed with the independent accountant their independence. Based on the review and discussions referred to above in this report, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in Quaint Oak Bancorp’s Annual Report on Form 10-K for fiscal year ended December 31, 2021,2023, for filing with the Securities and Exchange Commission.

Members of the Audit Committee |

Andrew E. DiPiero, Jr., Esq., Chairman |

Kenneth R. Gant, MBA |

Robert J. Phillips |

|

Pursuant to Section 951 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), the proxy rules of the Securities and Exchange Commission were amended to require that not less frequently than once every three years, a proxy statement for an annual meeting of shareholders for which the proxy solicitation rules of the Securities and Exchange Commission require compensation disclosure must also include a separate resolution subject to shareholder vote to approve the compensation of the company’s named executive officers disclosed in the proxy statement.

The executive officers named in the summary compensation table and deemed to be “named executive officers” are Messrs. Strong, Augustine and Gonzalez. Reference is made to the summary compensation table and disclosures set forth under “Executive Compensation” in this proxy statement.

The proposal gives shareholders the ability to vote on the compensation of our named executive officers through the following resolution:

“Resolved, that the shareholders approve the compensation of the named executive officers as disclosed in this proxy statement.”

The shareholder vote on this proposal is not binding on Quaint Oak Bancorp or the Board of Directors and cannot be construed as overruling any decision made by the Board of Directors. However, the Board of Directors of Quaint Oak Bancorp will review the voting results on the non-binding resolution and take them into consideration when making future decisions regarding executive compensation.

The Board of Directors recommends that you vote FOR the non-binding resolution

to approve the compensation of our named executive officers.

BENEFICIAL OWNERSHIP OF COMMON STOCK BY CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

The following tables below set forth, as of March 22, 2022,19, 2024, the voting record date, certain information as to our common stock beneficially owned by (a) each person or entity, including any “group” as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934 who or which was known to us to be the beneficial owner of more than 5% of our issued and outstanding common stock, (b) our directors, (c) certain executive officers of Quaint Oak Bancorp and/or Quaint Oak Bank, and (d) all directors and executive officers as a group.

Common Stock Beneficially Owned as of March 22, 2022(1) | ||||||||

| Name of Beneficial Owner | Amount | Percentage(2) | ||||||

| 5% Owners: | ||||||||

Quaint Oak Bancorp, Inc. Employee Stock Ownership Plan Trust 501 Knowles Avenue Southampton, Pennsylvania 18966 | 193,207 | (3) | 9.6 | % | ||||

Phil Lifschitz 7 Tulane Drive Livingston, New Jersey 07039 | 181,600 | (4) | 9.0 | |||||

Directors: | ||||||||

George M. Ager, Jr. | 50,752 | (5)(6) | 2.5 | |||||

John J. Augustine, CPA | 107,837 | (5)(7) | 5.3 | |||||

James J. Clarke, Ph.D. | 63,940 | (5) | 3.2 | |||||

Andrew E. DiPiero, Jr., Esq. | 39,288 | (5)(8) | 1.9 | |||||

Kenneth R. Gant, MBA | 45,390 | (5)(9) | 2.3 | |||||

Robert J. Phillips | 75,973 | (5)(10) | 3.7 | |||||

Robert T. Strong | 263,710 | (5)(11) | 12.7 | |||||

Other Named Executive Officer: | ||||||||

William R. Gonzalez | 38,881 | (5)(12) | 1.9 | |||||

All directors and executive officers as a group (11) persons) | 783,324 | (5)(13) | 35.7 |

Name of Beneficial Owner | Common Stock Beneficially Owned as of March 19, 2024(1) | |||

Amount | Percentage(2) | |||

| 5% Owners: | ||||

Quaint Oak Bancorp, Inc. Employee Stock Ownership Plan Trust 501 Knowles Avenue Southampton, Pennsylvania 18966 | 212,099 | (3) | 8.5 | % |

Phil Lifschitz 17555 Collins Avenue, UPH 1 Sunny Isles Beach, Florida 33160 | 181,600 | (4) | 7.3 | |

Directors: | ||||

George M. Ager, Jr. | 48,052 | (5)(6) | 1.9 | |

John J. Augustine, CPA | 123,763 | (5)(7) | 4.9 | |

James J. Clarke, Ph.D. | 68,440 | (5)(8) | 2.7 | |

Andrew E. DiPiero, Jr., Esq. | 38,827 | (5)(9) | 1.6 | |

Kenneth R. Gant, MBA | 47,890 | (5)(10) | 1.9 | |

Bora Ozkan Ph.D. | 2,200 | (5) | * | |

Robert J. Phillips | 79,073 | (5)(11) | 3.2 | |

Robert T. Strong | 278,021 | (5)(12) | 11.1 | |

Susan M. Vettori | 1,884 | (5) | * | |

Other Named Executive Officer: | ||||

William R. Gonzalez | 51,021 | (5)(13) | 2.0 | |

All directors and executive officers as a group (12) persons) | 810,076 | (5)(14) | 31.3 | % |

_______________________

(1) Based upon filings made with the Securities and Exchange Commission and information furnished by the respective individuals. Pursuant to regulations under the Securities

Exchange Act of 1934, shares of common stock are deemed to be beneficially owned by a person if he or she directly or indirectly has or shares (a) voting power, which includes

the power to vote or to direct the voting of the shares, or (b) investment power, which includes the power to dispose or to direct the disposition of the shares. Unless otherwise

indicated, the named beneficial owner has sole voting and dispositive power with respect to the shares. A person is deemed to have beneficial ownership of any shares of

common stock which may be acquired within 60 days of the record date pursuant to the exercise of outstanding stock options.

(2) Each beneficial owner’s percentage ownership is determined by assuming that options held by such person (but not those held by any other person) and that are exercisable

within 60 days of the voting record date have been exercised.

(3) Mr. John J. Augustine and Ms. Diane J. Colyer act as trustees of the Quaint Oak Bancorp, Inc. Employee Stock Ownership Plan Trust. As of March 22, 2022, 193,20719, 2024, 212,099 shares

held in the plan trust were allocated to individual accounts established for participating employees. In general, the allocated shares held in the plan trust as of March 22 2022,19, 2024,

will be voted by the plan trustees in accordance with the instructions of the participants. Unallocated shares, if any, are generally required to be voted by the plan trustees for or

against proposals to shareholders in the same proportion as the shares of Company Stock which have been allocated to the accounts of individual participants and their

beneficiaries are actually voted thereby, subject to each case to the fiduciary duties of the plan trustees and applicable law. The amount of our common stock beneficially

owned by officers who serve as plan trustees and by all directors and executive officers as a group does not include the shares held by the plan trust other than shares

specifically allocated to the individual officer’s account.

(Footnotes continued on following page)

_______________________

(4) Based on the most current information obtained by Quaint Oak Bancorp from Mr. Lifschitz. Mr. Lifschitz reported sole voting and dispositive power with respect to the

181,600 shares which represented 9.0%7.3% of our outstanding common stock at March 22, 2022.19, 2024.

(5) Includes share awards to directors and officers which are vesting within 60 days of the voting record date and stock options which have been granted to the directors and officers

under Quaint Oak Bancorp’s 2013 Stock Incentive Plan and 2018 Stock Incentive Plan which are exercisable within 60 days of the voting record date as follows:

Name | Stock Options | Share Awards | Stock Options | Share Awards | ||||||||||

George M. Ager, Jr. | 1,000 | 300 | 2,000 | 200 | ||||||||||

John J. Augustine, CPA. | 36,000 | 1,500 | ||||||||||||

John J. Augustine, CPA | 20,000 | 900 | ||||||||||||

James J. Clarke, Ph.D. | 1,000 | 300 | 1,100 | 200 | ||||||||||

Andrew E. DiPiero, Jr., Esq. | 9,500 | 300 | 5,000 | 200 | ||||||||||

Kenneth R. Gant, MBA | 4,000 | 300 | 4,000 | 200 | ||||||||||

Bora Ozkan, Ph.D. | 1,000 | 200 | ||||||||||||

Robert J. Phillips | 16,000 | 400 | 5,115 | 200 | ||||||||||

Robert T. Strong | 54,000 | 2,000 | 17,962 | 900 | ||||||||||

Susan M. Vettori | 1,000 | 200 | ||||||||||||

William R. Gonzalez | 12,000 | 1,000 | 14,220 | 900 | ||||||||||

All directors and executive officers as a group (11 persons) | 172,008 | 7,522 | ||||||||||||

All directors and executive officers as a group (12 persons) | 89,733 | 5,500 | ||||||||||||

(6) Includes 38,90238,602 shares held jointly with Mr. Ager’s spouse, and 7,250 shares held the individual retirement account of his spouse.

(7) Includes 3,000 shares held by Mr. Augustine’s spouse, 22,20025,200 shares held in Mr. Augustine’s individual retirement account, and4,395.98013,478.881 shares held in Mr. Augustine’s account in

the 401(k) Plan and 18,205.678020,126.9788 shares allocated to Mr. Augustine’s account in the ESOP.

(8) Includes 33,300 shares held jointly with Mr. Clarke’s spouse.

(9) Includes 2,000 shares held by Mr. DiPiero’s spouse and 10,00011,000 shares held in Mr. DiPiero’s individual retirement account.

(9)(10) Includes 20,000 shares held in Mr. Gant’s individual retirement account and 800 shares held in custody by Mr. Gant for his daughter.

(10)(11) Includes 53,91967,404 shares held jointly with Mr. Phillips’s spouse, 633608 shares held by his spouse and 1,4211,346 shares held in Mr. Phillips’s individual retirement account.

(11)(12) Includes 139,318192,933 shares held jointly with Mr. Strong’s spouse, 22,742 shares held in Mr. Strong’s individual retirement account, 8,494.2749,672.972 shares held in Mr. Strong’s account

in the 401(k) Plan and 34,035.404833,811.4388 shares allocated to Mr. Strong’s account in the ESOP. The address for Mr. Strong is c/o Quaint Oak Bank, 501 Knowles Avenue,

Southampton, Pennsylvania 18966.

(12)(13) Includes 741.59781,010.3599 shares allocated to Mr. Gonzalez’s spouse in the Quaint Oak Bancorp ESOP, 9,680.64512,674.151 shares held in Mr. Gonzalez’s account in the 401(k) Plan and 10,258.8912

11,723.9301 shares allocated to Mr. Gonzalez’s account in the ESOP.

(13)(14) Includes an aggregate of 27,121.5551shares41,922.2180 shares of common stock held in the 401(k) Plan and 91,651.151785,228.7219- shares of common stock which are held by the Quaint Oak Bancorp, Inc.

ESOP on behalf of our executive officers as a group.

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers and directors, and persons who own more than 10% of Quaint Oak Bancorp, Inc.’s common stock to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Officers, directors and greater than 10% shareholders are required by regulation to furnish us with copies of all Section 16(a) forms they file.Other than Mr. Strong, we know of no person who owns 10% or more of our common stock. Based solely on review of the copies of such forms furnished to us, or written representations from our officers and directors, we believe that during, and with respect to, 2021,2023, all of our officers and directors complied in all respects with the reporting requirements promulgated under Section 16(a)., with the exception of Mr. Ager who was late reporting two gifts of common stock on Form 5.

SHAREHOLDER PROPOSALS, NOMINATIONS AND COMMUNICATIONS WITH THE BOARD OF DIRECTORS |

Shareholder Proposals. Any proposal which a shareholder wishes to have included in the proxy materials of Quaint Oak Bancorp relating to the next annual meeting of shareholders, which is expected to be held in May 2023,2025, must be received at our principal executive offices located at 501 Knowles Avenue, Southampton, Pennsylvania 18966, Attention: Diane J. Colyer, Corporate Secretary, no later than December 7, 2022.4, 2024. If such proposal is in compliance with all of the requirements of Rule 14a-8 under the Exchange Act, it will be included in the proxy statement and set forth on the form of proxy issued for such annual meeting of shareholders. It is urged that any such proposals be sent certified mail, return receipt requested.

Shareholder proposals which are not submitted for inclusion in our proxy materials pursuant to Rule 14a-8 under the 1934 Act may be brought before an annual meeting pursuant to Section 2.10 of our Bylaws, which provides that the shareholder must give timely notice thereof in writing to the Corporate Secretary. To be timely with respect to the annual meeting of shareholders expected to be held in May 2023,2025, a shareholder’s notice must be delivered to, or mailed and received at, our principal executive offices no later than December 7, 2022.4, 2024. A shareholder’s notice to the Secretary shall set forth as to each matter the shareholder proposes to bring before the annual meeting the information required by Section 2.10 of our Bylaws.

Shareholder Nominations. Our Bylaws provide that, subject to the rights of the holders of any class or series of stock having a preference over the common stock as to dividends or upon liquidation, all nominations for election to the Board of Directors, other than those made by the Board or the Nominating Committee thereof, shall be made by a shareholder who has complied with the notice provisions in the Bylaws. Written notice of a shareholder nomination generally must be communicated to the attention of the Corporate Secretary and either delivered to, or mailed and received at, our principal executive offices not later than, with respect to an annual meeting of shareholders, 120 days prior to the anniversary date of the mailing of proxy materials by us in connection with the immediately preceding annual meeting of shareholders. For our annual meeting in 2023,2025, this notice must be received by December 7, 2022.4, 2024. Each written notice of a shareholder nomination is required to set forth certain information specified in Section 3.12 of Quaint Oak Bancorp’s Bylaws. We did not receive any shareholder nominations with respect to this annual meeting.

Other Shareholder Communications. Our Board of Directors has adopted a formal process by which shareholders may communicate with the Board. Shareholders who wish to communicate with our Board of Directors may do so by sending written communications addressed to the Board of Directors of Quaint Oak Bancorp, Inc., c/o Diane J. Colyer, Corporate Secretary, 501 Knowles Avenue, Southampton, Pennsylvania 18966.

ANNUAL REPORTS |

A copy of our Annual Report to Shareholders for the year ended December 31, 20212023 accompanies this proxy statement. Such annual report is not part of the proxy solicitation materials.